Are you considering investing in gold to secure your financial future? With the world’s economy constantly fluctuating, it’s no surprise that people are looking for ways to diversify their investment portfolios and protect their wealth. In recent years, gold has become an increasingly popular choice among investors due to its historical stability and potential for long-term growth.

But is investing in gold a smart move for your financial future? The answer depends on various factors, including your investment goals, risk tolerance, and current market conditions. Before we dive into the details, let’s take a look at some of the benefits and risks associated with investing in gold.

Benefits of Investing in Gold:

- Diversification: Gold can serve as a hedge against inflation, currency fluctuations, and market volatility. By including it in your portfolio, you can reduce your overall risk exposure.

- Historical Stability: Gold has been a store of value for centuries, retaining its purchasing power over time. This stability makes it an attractive option for investors seeking long-term growth.

- Tangible Asset: Physical gold, such as coins or bars, provides a tangible asset that can be held in your hand. This can offer a sense of security and control.

Risks Associated with Investing in Gold:

- Market Volatility: The price of gold is subject to market fluctuations, which can result in significant losses if you’re not prepared.

- Counterparty Risk: When investing in paper gold (e.g., ETFs or futures), there’s a risk that the counterparty (the institution issuing the instrument) may default on their obligations.

- Storage and Maintenance Costs: Physical gold requires storage space, insurance, and maintenance costs, which can eat into your returns.

Buying Gold in Jordan:

For those living in Jordan or considering investing in the country, there are several options to buy gold. Bank al Etihad, for instance, offers a range of gold investment products for its clients. Whether you’re looking to diversify your portfolio or gift an ounce of gold as an investment in a loved one’s future, their branches provide various options to meet your needs.

In conclusion, investing in gold can be a smart move for your financial future if done correctly. By understanding the benefits and risks associated with this precious metal, you can make informed decisions about how to incorporate it into your portfolio. Remember to always diversify your investments, monitor market conditions, and consider the costs of storage and maintenance before making a purchase.

Tips for Investing in Gold:

- Set clear investment goals: Define what you want to achieve through gold investing.

- Diversify your portfolio: Don’t put all your eggs in one basket – spread your investments across different asset classes.

- Research and understand fees: Be aware of the costs associated with buying, storing, and maintaining physical gold or paper gold instruments.

- Monitor market conditions: Keep an eye on economic indicators, interest rates, and commodity prices to make informed investment decisions.

By following these tips and taking a thoughtful approach to investing in gold, you can make the most of this valuable asset and secure your financial future.

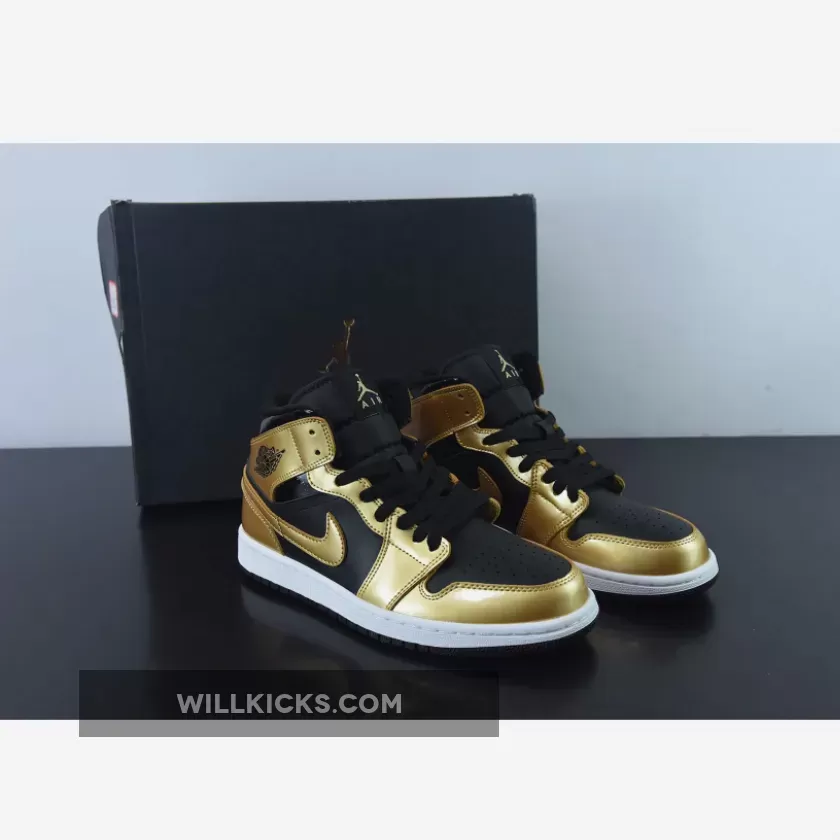

Buy From: Air Jordan 1 Mid Black/Metallic Gold-White DR6967-071, black/metallic gold-white jordan 1

Buy From: Air Jordan 1 Mid Black/Metallic Gold-White DR6967-071, black/metallic gold-white jordan 1